Welcome to our blog post on the best credit cards for bloggers and freelancers! If you’re a freelancer or blogger, you may be wondering if a credit card is right for you, and if so, which one to choose. In this article, we’ll discuss the pros and cons of using a credit card as a freelancer or blogger, as well as our top 3 recommendations.

But first, let’s address the question of whether you should consider getting a credit card at all. On one hand, credit cards can be a useful financial tool for freelancers and bloggers, as they can help you establish a credit history, earn rewards, and have access to a line of credit in case of emergencies.

On the other hand, it’s important to be mindful of the potential risks and downsides of using a credit card, such as the risk of overspending or falling into debt. Best Credit Cards for Bloggers and Freelancers

ALSO CHECKOUT: Step-By-Step Guide on Tax for Freelancers in India

3 Benefits of Using a Credit Card that Debit Card Users Will Never Get:

1. Rewards:

Credit card users can earn a variety of rewards, such as coupons and cashbacks, by using their card responsibly and paying their bills on time. These rewards can be substantial, with some credit card companies offering up to 5% cashback on purchases.

It’s important to note that these rewards are often used as a marketing tactic to encourage people to spend more, so it’s important to only spend what you would have spent anyway. Best Credit Cards for Bloggers and Freelancers

It’s also worth considering the merchant’s perspective, as credit card companies charge higher transaction fees to merchants compared to debit cards. These fees, which can be as high as 5%, are ultimately passed on to the consumer in the form of rewards.

2. Interest-Free Money:

Using a credit card allows you to borrow money interest-free for a certain period of time, typically 30 to 40 days. This can be useful if you need to make a large purchase but don’t have the funds available at the time.

Some businesses, such as those operating on Shopify, rely on credit cards to finance their inventory and other expenses, as they may not receive payment for their products or services until 30 days or more after the sale.

3. Security:

Credit cards offer a higher level of security compared to debit cards. For example, if you notice an unauthorized charge on your credit card, you can report it to the credit card company and have it investigated.

The credit card company will then refund the charge if it is found to be fraudulent. Debit card users, on the other hand, may have to visit a bank in person to resolve any issues.

Credit cards also provide an additional layer of security online, as you do not have to share your bank account information with merchants.

Advantages & Disadvantages of Using Credit Cards

Top 5 Advantages of Using Credit Cards for Indian Entrepreneurs

- CONVENIENCE: Credit cards provide a convenient and easy way to make payments and purchase goods and services without having to carry cash.

- CREDIT BUILDING: Using a credit card responsibly can help an entrepreneur build a good credit score, which can be useful for obtaining loans or other forms of financing in the future.

- REWARDS AND DISCOUNTS: Many credit cards offer rewards and discounts on purchases made with the card, which can be beneficial for entrepreneurs looking to save money on business expenses.

- FRAUD PROTECTION: Credit Cards offer protection against fraudulent charges, which can be especially important for entrepreneurs who may be at a higher risk for fraud due to their business dealings.

- FLEXIBILITY: Credit cards offer flexibility in terms of payment options, as entrepreneurs can choose to pay off their balances in full each month or make partial payments with interest. This can be helpful for managing cash flow and financial planning.

Top 5 Disadvantages of Using Credit Cards for Indian Entrepreneurs

- HIGH INTEREST RATES: Credit cards can have high interest rates, which can be a disadvantage for entrepreneurs who carry a balance on their card. If an entrepreneur is unable to pay off their balance in full each month, they may end up paying a significant amount in interest charges.

- RISK OF OVERSPENDING: Credit cards can make it easy for entrepreneurs to overspend, which can lead to financial problems if they are not careful. It is important for entrepreneurs to set a budget and stick to it to avoid accumulating excessive debt.

- FEES: Credit cards may come with a variety of fees, including annual fees, balance transfer fees, cash advance fees, and late payment fees. These fees can add up and negatively impact an entrepreneur’s financial situation.

- CREDIT SCORE IMPACT: If an entrepreneur does not use their credit card responsibly, it can negatively impact their credit score. This can make it more difficult for them to obtain loans or other forms of financing in the future.

- SECURITY RISKS: Credit cards involve the sharing of personal and financial information, which can be vulnerable to security breaches. Entrepreneurs should be careful to protect their credit card information and monitor their accounts for suspicious activity.

3 Best Credit Cards for Bloggers or Freelancers:

Are you looking for a credit card that caters to your needs as a blogger or freelancer? Look no further! Here are the 3 best credit cards for bloggers and freelancers:

1. Amazon Pay ICICI Bank Credit Card

If you’re an Amazon fan, this credit card is a no-brainer. It offers good cashbacks, a 5% discount on Amazon purchases, and 2 to 4% cashback on other transactions. Plus, there’s no annual fee to worry about.

- Offers good cashbacks

- Provides up to 5% discount on Amazon purchases

- Offers 2 to 4% cashback on other transactions

- No annual fee

How to Apply for Amazon Pay ICICI Credit Card?

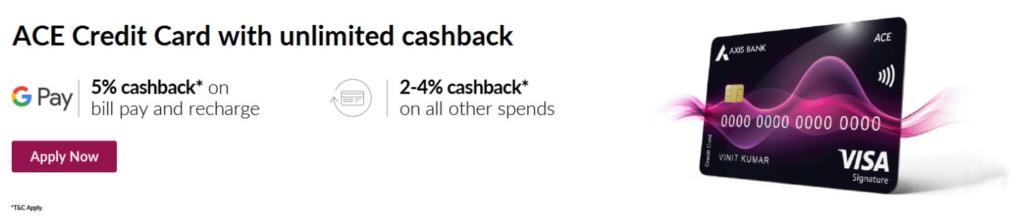

2. Axis Ace Credit Card

This credit card is perfect for bloggers and freelancers who make a lot of bill payments and recharges. It offers a generous 5% cashback on these transactions, as well as 2 to 4% cashback on all other spending.

- Offers 5% cashback on bill payments and recharges

- Provides 2 to 4% cashback on all other spending

How to Apply for Axis Ace Credit Card?

3. SBI Simply Click Credit Card

While it has an annual charge of 500, the SBI Simply Click credit card still offers decent rewards. It may be a good choice for those who are looking for a credit card with a lower annual fee. Best Credit Cards for Bloggers and Freelancers

- Annual charge of 500 Rupees

- Offers decent rewards

How to Apply for SBI Simply Click Credit Card?

The Bottomline: Best Credit Cards for Bloggers and Freelancers

Overall, these three credit cards offer great benefits for bloggers and freelancers. Whether you’re looking for cashback on Amazon purchases or bill payments, there’s a credit card that caters to your needs. Choose the one that best suits your financial situation and start reaping the rewards!

If you’re new to using credit cards, the SBI Simply Click credit card might be a good choice for you. You can find more information about this credit card on their website. Best Credit Cards for Bloggers and Freelancers

It’s worth noting that the Reserve Bank of India (RBI) has recently imposed a ban on American Express and HDFC from issuing new credit cards. That’s why they’re not included in this list. Best Credit Cards for Bloggers and Freelancers

We hope this article has been helpful in your decision-making process. Remember, whether or not a credit card is right for you will depend on your individual financial situation and spending habits. Do your research and choose a card that fits your needs and budget.

Pingback: How to Get a USA Mobile Number from Any Country? 5 Best Ways to Get a USA Phone Number - MOSΔM

Pingback: How to Register a Private Company In Bangladesh (2023)? - CEOColumn

Pingback: OneCard Review 2023 – Free Metal Credit Card for Indians - MOSΔM